The benefits of long term investment are directly correlated with your willingness to pursue greater rewards on a pre-decided amount over time. While this is often done through the stock market, many other types of longer term investments exist, including real estate and business investment.

One of the most successful investors of all time, Warren Buffett, said that if you don’t feel comfortable owning a stock for 10 years, you shouldn’t own it for 10 minutes. This statement implies that for you to fulfill your life’s biggest expenses and retire in comfort, it is a must to invest for the long term in stable investments that you understand. Following are some of the advantages of long term investment that will help you become a successful investor.

Explore what your investment today can do for you in the long term with the CWS Financial Planning Calculator, a powerful compound interest app.

5 key advantages of long term investment

1. It keeps you from making emotional decisions

There are a lot of advantages of long term investment, but nothing quite as important as taking market volatility out of the equation. When you are new to investing, the first sign of fluctuations in prices could compel you to sell your investment. But it’s vital for you to note that the prices never reach higher numbers without fluctuating from time to time. Also, the market tends to show sustained growth in the long run. So when you stick with a long term investment plan, you won’t let your emotions take over and make bad decisions trying to pursue financial gains in the short term.

2. Minimum trading fees and lower taxes

Whenever you buy or sell an investment, there is generally a cost (trading fees, closing costs, etc.). The more you buy or sell, the more costs are incurred. But long term investing limits your transactions, keeping these expenses to a minimum. Also, when you invest long term, you can enjoy lower taxes as long term gains have a lower tax rate than short term gains.

3. Allows you to utilize the power of compounding

3. Allows you to utilize the power of compounding

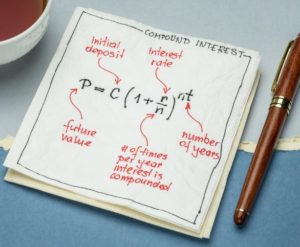

Compounding is a process of reinvesting the earnings from a particular investment to produce higher growth constantly. That’s why when you start investing long term, the earnings on your investments get compounded regularly. With that, you truly utilize the power of compounding to your benefit and maximize your investment returns. Suppose you want to understand how much a particular long term investment will return after a set period, including compound interest. In that case, you can use an all-in-one compound interest app for running these complex scenarios.

4. Highly effective and less time-consuming

Long term investments are highly effective because you concentrate with a greater focus on the company (or property, or other investment) you are putting your money in. You check whether they have an excellent business model, sound management, the right market, a decent rate of return, and visible growth opportunities while not prioritizing the day-to-day fluctuations in prices. Also, investing long term is less time-consuming because your work is essentially done when you put your money into the investment. One of the most significant advantages of long term investment is that it tends to retain a competitive edge for a prolonged duration to bring you consistent rewards. Short term investments, on the other hand, require your frequent and continuous efforts for any monetary earnings.

5. Fulfills your long term financial goals

Whether you are looking to save up money to buy a house, plan your wedding, book your dream vacation, pay for your children’s education, fund your retirement, and so on, long term investment is a great option. You may need to make adjustments with your current lifestyle by spending more thoughtfully, so you have the funds to put into a long term investment plan. The earlier you take these steps, the greater will be the compounding effect on your investment. Eventually, investing long term will lead you to consistently higher rates of return, which will help you fulfill your long term financial goals.

Getting started with long term investment

You can get started with long term investment either on your own or seek help from a financial advisor. It depends on your personal investment style and the potential risk associated with a particular investment you make. The advantages of long term investment are very compelling, but still, you should be very careful about not throwing all your money into one single investment option. With the assistance of the CWS Financial Planning Calculator, you can make the calculation process easier and clearer while giving yourself greater confidence and decisiveness as you plan your long term investment. Download the unique compound interest app today from the App Store or Google Play to start planning now.